In this post I am going to guide you through the process of how to set yourself up as a your very own VFX studio. In practice this post can relate to setting yourself up as your own business, whatever industry you are in, but seeing as this a VFX oriented site I'll use the business model of a VFX studio for the purpose of this exercise.

Most of us VFX and animator types are employed as freelancers or contractors, there are very few staff positions in this industry so knowing how you can maximise, conserve and stretch your pay is really vital especially in the economic climate we find ourselves in. A lot of the specifics that I will mention relate to UK tax law, it is the same concept whichever country you are in, they just have different names and are set at different level (maybe you can substitute in the names and percentages in the comments below for your own country).

I am going to use an example to show how you can earn the same day rate but take home more money, all names and figures are arbitrary, so don't be disheartened if the pay scale is not what you are receiving or seems too low, I'm using round numbers purely for simple illustration. None of this is meant as legal or financial advice, please consult your own accountant for this.

Why set yourself up as a limited company?

Setting yourself up as a limited company is quite simple to do in practice, but there are a few initial tasks and then many continuous tasks that you'll need to dedicate time to. So you are probably wondering why go through all of that in the first place.

Well the answer is simple and can be summed up in two words.

SAVING TAX

yes it's that simple all the extra admin that you will do is simply to save you some/a lot of tax.

Let's look at an example, in the UK there are various tax bands (again these bands exist in your own countries, they have different names and are set at different rates but they do exist) understand how the tax system works and where you fit into it and you will see how advantageous and worthwhile the extra admin is.

From the HMRC website http://www.hmrc.gov.uk/budget2012/income-tax-rates.htm (what a thrilling read that is)

'For 2013-14, the main rates of income tax will be the 20 per cent basic rate, the 40 per cent higher rate and the additional rate will be reduced from 50% to 45%.'

i.e. when you earn more than £42,475, you can expect to pay 40% on that amount. Most if not all VFX artists that I know earn more than this amount. Therefore they are losing (I mean paying) 40% of any money above this figure.

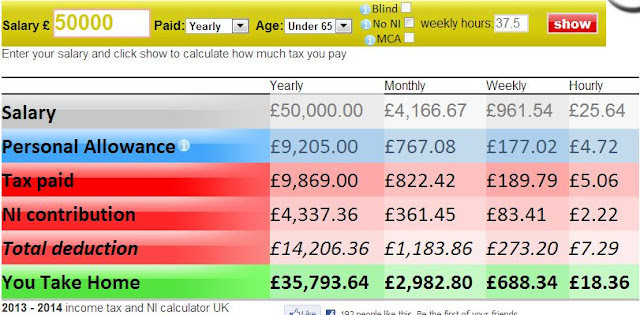

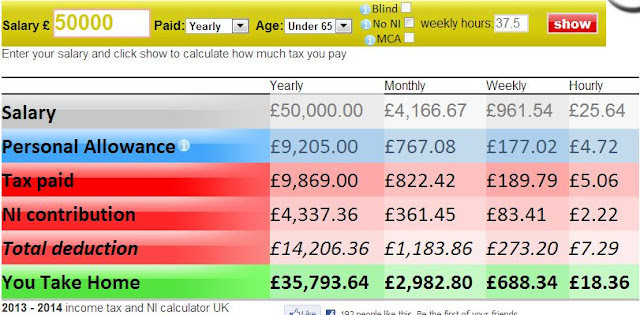

Using the http://iknowtax.com/2013/ calculator, someone on a day rate of £200 will essentially take home £50k, assuming a two week holiday.

|

| Fig1. Take home £35,793 when you earn £50,000 |

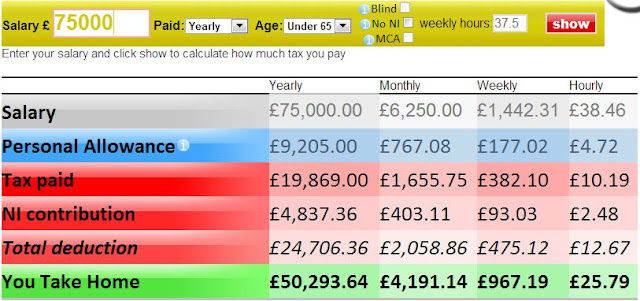

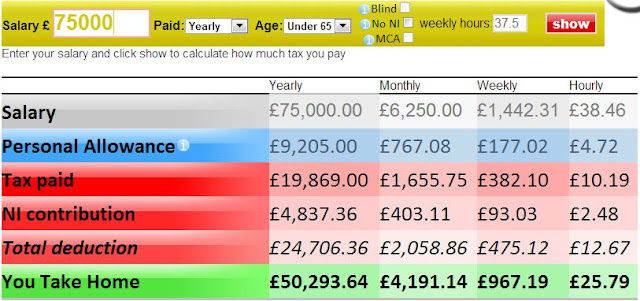

Now imagine you are on a day rate of £300, i.e. £75,000, a perfectly reasonable amount for an experienced VFX artist.

|

| Fig 2. Take home £50k when you earn £75k |

You can see now that you are really only taking home two-thirds of your pay. What essentially is happening is that you are being taxed at a standard rate of 20% after your personal allowance (i.e. the first £7,800), then taxed at 40% after you reach £42,475. Therefore if you are earning these kinds of money as a freelancer you are going to be taking home two-thirds of your pay.

Now contrast that with being a limited company where you would pay 20% on any pretax profit.

So how do you work out pretax profit?

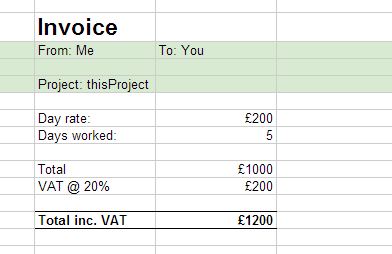

Well before we talk about that we are going to talk about another tax, in the UK it is called Value Added Tax (VAT), don't worry this isn't necessarily a bad tax, well that is to say it's not one that you will have to pay, but moreover, one that you will charge to your client. VAT is currently charged at 20% therefore for example if you were to charge as per our first example above, £200 a day, you would add on 20% to that.

£200 + 20% = £240 a day.

But here's the clever thing about charging VAT

i. your client can claim that back, thus reducing their pretax profit by the VAT you have charged them and

ii. you don't pay the full 20% to the government, you pay 14% of that, or 13% if you are trading in your first year, assuming that you are not on the flat rate scheme, if you are then you pay the full 20%.

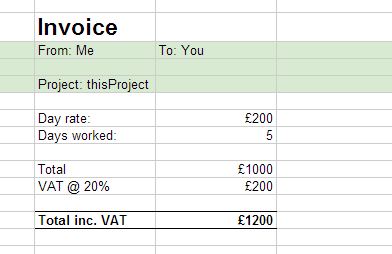

In practice that means, you do a week's work at £200 a day. You bill them as in fig 1.3

|

Fig 3. Charging VAT at 20%

|

now the Inland Revenue will charge you 14% or 13% if you are in your first year, i.e. they will charge you 13% of £1200, i.e. you pay the Inland Revenue VAT of

£156 (at 13% if it's your first year)

therefore you make £44 extra, which is an extra 7.3%.

When you consider that this £200 extra in VAT didn't exist when you were a freelancer, it is a win-win situation. The client reduces their tax exposure by

£200, you made

£156 for the exchequer and you pocket

£44 yourself for the trouble. Extrapolate that out to a year...

Now onto the aspect of your own tax bill and reducing it through expenses and wages.

First are you married, with a partner? If yes, is that partner working? If the answer is 'no' then you can pay them a wage too. This is how it works using a simple profit and loss equation using yourself and your partner (who isn't currently working) and whatever expenses you can charge (more on allowable expenses below)

|

| Fig 4. pay yourself and your partner a wage reduces your tax liability |

|

In Fig 4. You can see how paying yourself and your partner a minimum wage (currently in the UK set at £650 a month) and the company's expenses you end up paying corporation tax of

£211.60 on earnings of £3000, i.e. less than 10%.

Now if you have a child who needs to go to nursery, you can have the nursery invoice the company directly as a service provider. Fig 5 shows how that affects your tax payment

|

| Fig 5. Having the childcare provider directly invoice the company will reduce the tax bill further |

Now if the nursery charges £500 a month say then your tax bill is now

4.8% (£146/£3000) from the 40% that you would have been paying (assuming this month's payment was over the standard rate tax threshold).

All in all you can see how setting yourself as a limited company is going to make sure you keep more of your hard earned money.

Question: Why are you paying yourself minimum wage?

You do this so that your personal income stays below the standard rate tax threshold, i.e. so you don't pay income tax. Your tax payment should go through your corporation tax or at least the majority should go through the corporation tax.

Question: What are allowable business expenses?

Anything that is directly involved in you doing your job. Examples include

- computer hardware related to your job

- computer software related to your job

- training courses/books related to your job

- travel to see clients (note that commuting is not allowed, but if you have a contract that is less than 40% of the year, you can claim that travel cost)

- home office provided that you use the home office for actual work purposes you can then apportion a percentage of your mortgage/rent and bills to the expenses, for instance

- one of your rooms in your five room apartment you use exclusively for a home office, then you can put 20% of the mortgage and bills through as a business expense.

- If you use this room half the time for work and half the time for non work then you can apportion 10% of the associated costs as a business expense.

Note that the amount you set this split is the amount of time the room is used not the total time in the week, for instance if you get home and have four hours in the evening, then you measure how much of that four hours is spent for work and how much spent for leisure.

Question: why is there a £100 charge for an accountant?

See how much money he/she saves you, it's a cost worth having.

Question: my wife/girl friend is pregnant, can she claim maternity pay?

Congratulations (I hope you find the guy who did it :), yes she can so long as she has been employed for more than twenty four weeks.

How to set yourself up as a limited company?

This is really simple

- Find a good accountant, he/she will do most of the work - this will take about an hour

- Fill out the forms they give you, don't worry - this will take ten minutes

- Go to the bank and tell them you want to open a business account, that you will need two accounts, one a current account (where you will get paid) and the other a deposit account (where you will put aside any tax money to be paid to the inland revenue) this will take about an hour

- Say no to the bank when they try to sell you a slew of useless products for your new business account - this will take about an hour plus time on the phone as they will continue to call you afterwards since you are now a valued business customer

- Give all the details back to the accountant, he/she will send you a form to sign and then wait for the paperwork to come through. - this will take ten minutes to collate and send

What will it cost you?

Money

Accountant about £100 a month, i.e. £1200 a year

Payroll about £300 a year (you could do it yourself but it is a real hassle, most accountants have payroll departments attached)

Time

About a week of solid work to set up and running.

An hour each month (spread out over the whole month) to collate all your expenses - collecting and organising receipts

An hour each month to calculate your expenses

An hour each month to make all the bank transfers

Is it immoral?

People who aren't doing it will make you feel that it is (they're just upset that they are too lazy or not as smart as you to have figured it out) but no it isn't and anyone who says it is is an idiot.

You are running a business, every business has costs. If you ran a sandwich shop would you not write the bread, the cheese, the salami off as a business cost? Would the knives, plates, grill not be legitimate business tools? Would you not have to pay the electricity bill? Would you not pay your staff?

Running a VFX Studio means you have to pay a slew of costs as well, just like in any other business you subtract these costs from your revenue to work out your net profit. You then pay corporation tax on this figure.

Anyone who tells you otherwise, point them to the fact that you charge value added tax @ 20%. That is 20% extra money that never existed if you were on Pay as You Earn (PAYE). In the example above you have made £600 extra on an earning of £3000. If you were on the flat rate VAT scheme all that £600 would go straight to the exchequer, i.e. that's 20% up front straight away into the tax pot - how it will be squandered from there is the civil service's responsibility